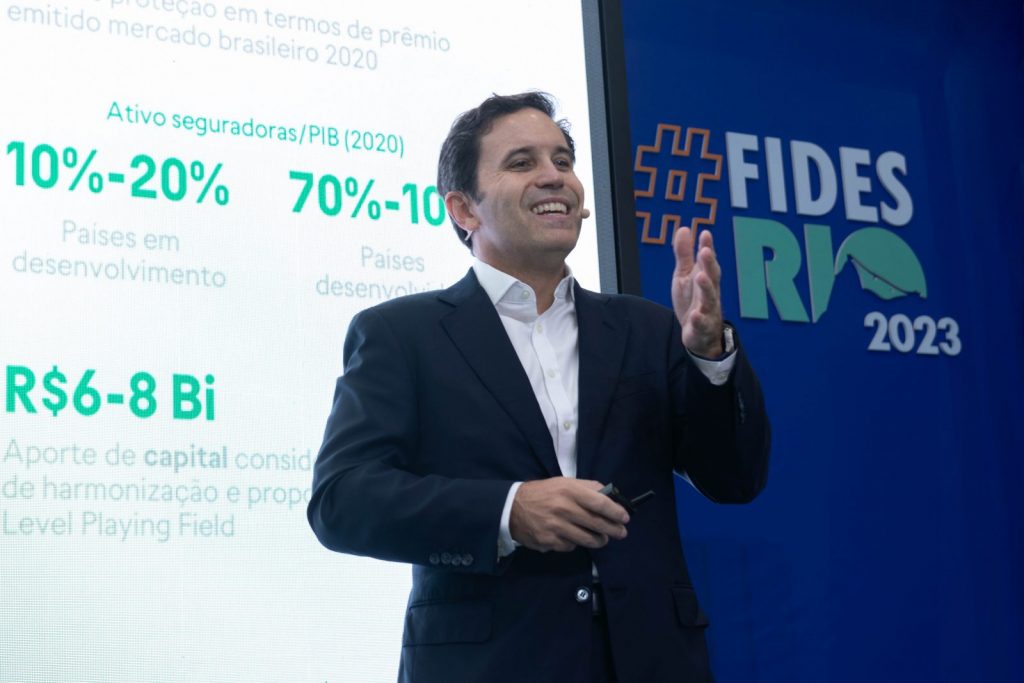

“Protection gap in Brazil is R$420 billion in insurance premiums.” This is what the Vice President of Finance, Actuary and Technology of IRB(Re), Rodrigo Botti, pointed out during a presentation yesterday (Sept 26) at Fides Rio 2023. The executive defended a growth model “more aligned with the model of developed countries” and highlighted that, after 15 years of open market, the Brazilian reinsurance sector needs to advance with quality. “It is necessary to reduce the protection gap and increase the total assets of insurance companies so that the sector can contribute to economic growth,” he stated.

Based on work carried out by the E&Y consultancy, the reinsurance sector registered an expansion of 12%, but the reinsurance gap, in the same period, increased 20%. “The Brazilian reinsurance market registered only a small increase in risk retention, with a large migration of premiums out of the country,” he said, adding: “We must choose between the US model, which relies on the use of collateral associated with the insurance market, and the European one, which encourages local presence.”

Botti highlighted some movements that should be prioritized in Brazil, following the example of developed countries. These movements include encouraging risk retention, providing an increase in internal savings, and changing investment rules in order to promote more flexibility for the use of properties as guarantor assets.

Despite the challenges, the Vice President of IRB(Re) highlighted that there are many opportunities in the Brazilian market, including through public-private partnerships: “Brazil has, for example, more than R$1 trillion in public assets, roads and hospitals without insurance coverage”.